Welcome to Green Innovation

green technology & eco friendly homes

Green Investment Tips

10 Eco Friendly Investment Tips

1. Decide what you mean by Eco Friendly

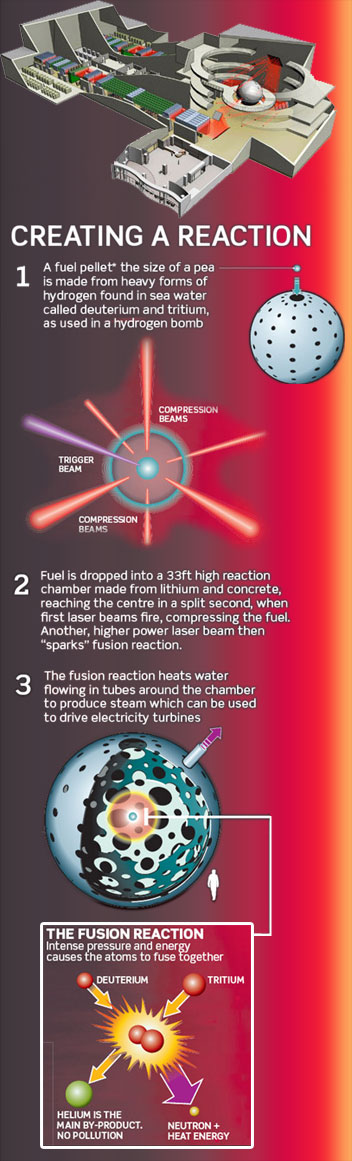

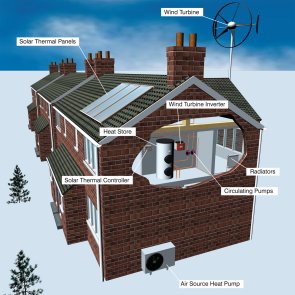

Are you opposed to nuclear energy, or do you see it as a practical solution to global warming? How do you feel about biofuels with all the ethical and environmental questions they raise? Do you wish to discriminate on grounds other than environmental - many ecofriendly funds are also ethical funds and screen out businesses involved in alcohol, tobacco, pornography and animal testing. Are these causes that you feel strongly about?

2. Do your research

A number of fund managers have strong teams looking at Eco Friendly investing including Aegon, F&C, Jupiter, Legal & General, Norwich Union and Standard Life.

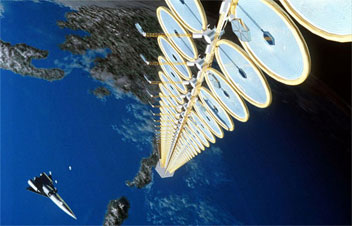

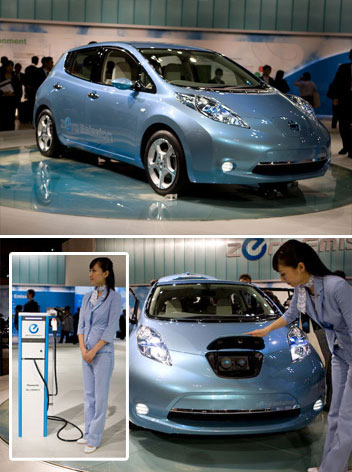

Some of these funds have a list of companies that they will not invest in because they are polluters or their environmental track record is not good. Other Eco Friendly funds will actively invest in companies working in socially responsible areas such as pollution control and clean fuels.

Blackrock New Energy investment trust and Triodos Renewable Energy fund are "pure-play" environmental funds.

3. Find an ethical IFA

A good adviser should draw up your personal eco profile before recommending any funds.

4. Consider your attitude to risk

Renewable energy start-ups can be high-risk. If you're a low-risk investor you might want to avoid stocks and shares altogether.

To reduce risk, don't put all your money into one fund or sector. Instead spread it between different funds, sectors and geographical areas around the world.

5. Use your tax breaks

Most eco friendly investment funds can be held inside your annual £7,200 Isa wrapper, which means you escape most income tax and all capital gains tax on the money you make.

Ecology building society, Triodos offer eco-friendly cash Isas.

Ecology's Earthwise cash Isa currently pays 5.1 per cent, provided you make no more than one withdrawal a year - otherwise the rate is 4.1 per cent. The Triodos cash Isa pays 4.4 per cent and Co-operative Bank's cash Isa pays 4.75 per cent.

6. Choose an eco-friendly pension

Plenty of pension companies offer ethical funds, but do some research to see if their investments are green. Many have holdings in large mining corporations, oil giants like BP, Shell, Total and other environmentally questionable companies.

7. Choose your manager carefully

Does your fund managers approach look rigorous and does the fund have a specialist team. A green fund manager should be looking for new investment opportunities in areas such as organic food, climate change, and waste and water.

8. Manage your expectations

Environmentally friendly funds are at a disadvantage when competing against those funds that are free to invest in any company, and are likely to see smaller returns.

9. Monitor performance

Strike a balance between principles and profit. Don't just examine where the fund invests - check how it has performed (but remember, past performance is no guarantee of future returns).

10. Our Tip

The Aegon Ethical Equity fund has very strict investment criteria but has also performed strongly.

© Copyright 2004-2026 - greeninnovation

Green Investment Tips

disclaimer | sitemap | links